Revolutionize Financial Services in Kuwait

Empower banks, exchange houses, and insurance providers to deliver instant transaction alerts, enhance data security, and offer seamless customer support directly on WhatsApp. Build trust and efficiency with the communication channel your clients use every day.

How Jetbot Powers Kuwaiti Financial Institutions

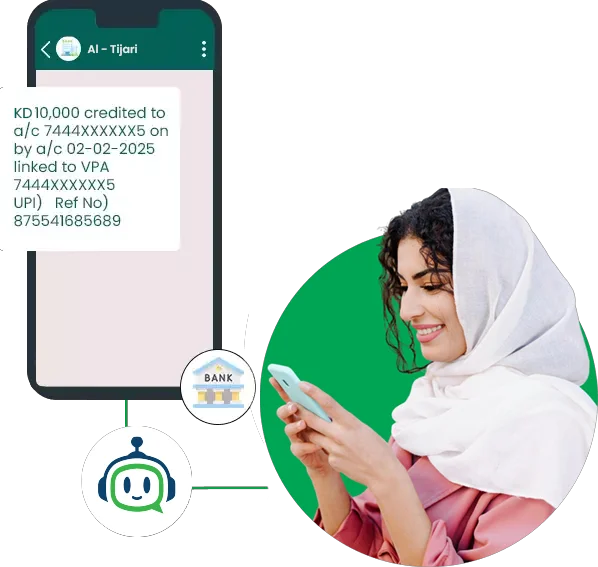

Deliver real-time notifications for K-Net purchases, salary credits, and international transfers. Replace delayed SMS messages with instant WhatsApp alerts to give your customers immediate peace of mind.

rotect sensitive client information with advanced contact masking and end-to-end encryption. Ensure all communications comply with global security standards (ISO 27001) and local financial regulations.

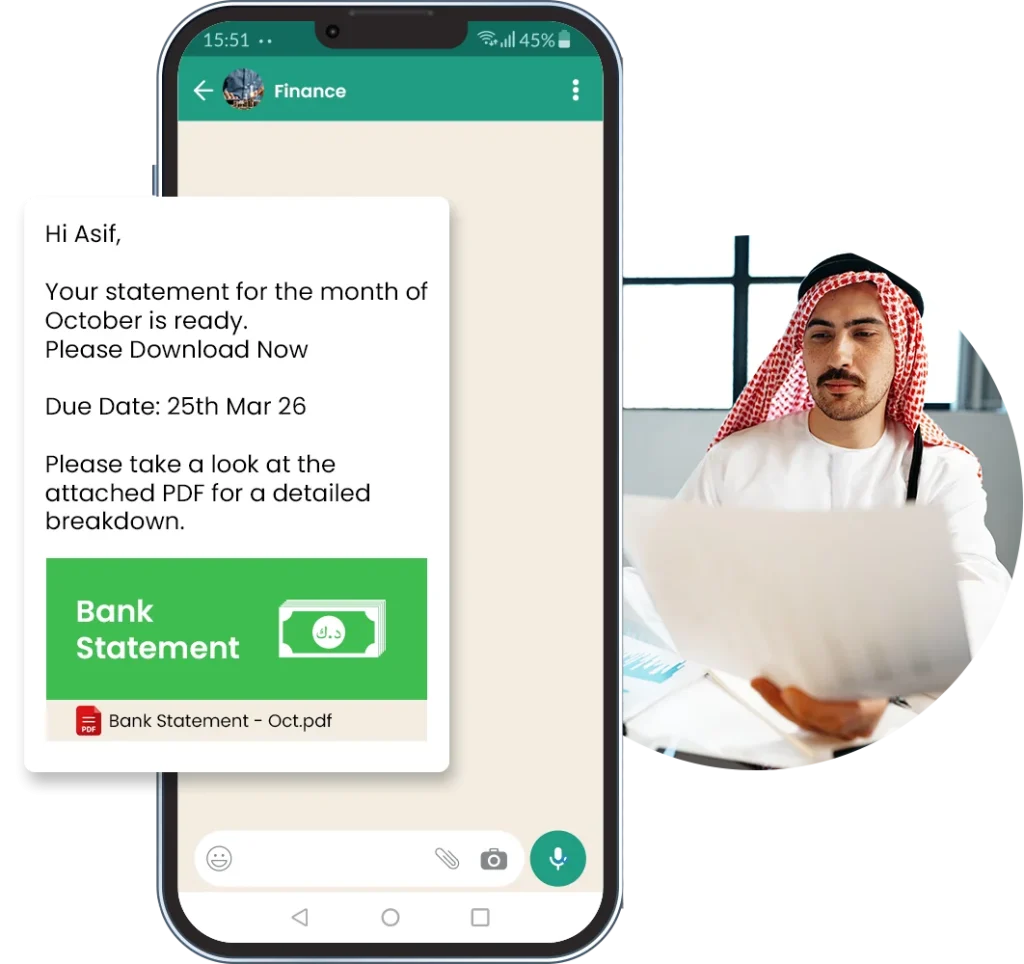

Reduce late payments and lapsed policies by sending automated, gentle reminders for loan installments (EMIs), credit card dues, and insurance renewals directly to the customer’s phone.

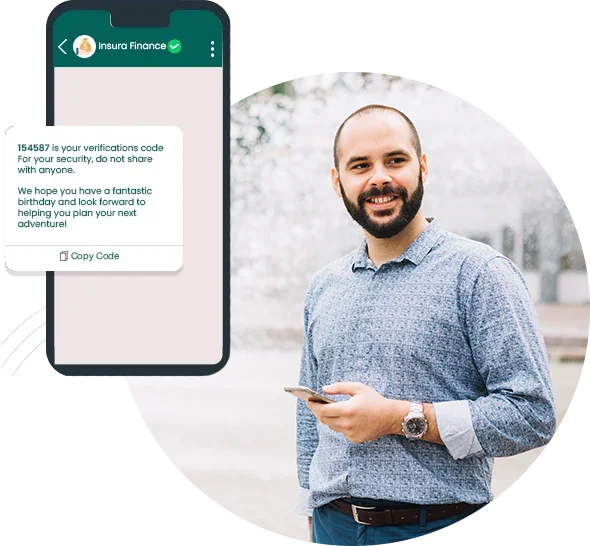

Simplify user logins and transaction verifications with WhatsApp-based OTPs. innovative 2-factor authentication that is faster and more reliable than traditional SMS, ensuring seamless access for your clients.

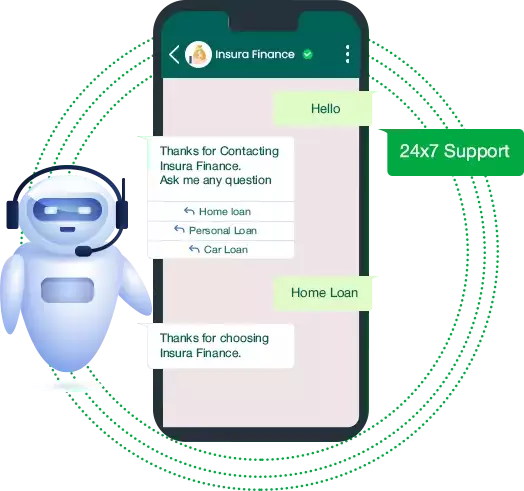

Empower your customer service team to manage high volumes of inquiries from a single dashboard. Assign conversations to specific agents—like "Loans" or "Credit Cards"—to ensure professional, consistent, and timely assistance in both Arabic and English.

Why Choose WhatsApp for Your Finance Business Growth?

Why Jetbot is the Strategic Partner for Financial Institutions

Protect sensitive client information and build unwavering trust. Our advanced masking features ensure that your relationship managers can communicate securely with clients without exposing personal phone numbers, keeping you compliant with strict data privacy standards

Send critical market updates, exchange rate alerts, or holiday announcements to your entire customer database instantly. Unlike standard bulk messaging, our official API connection ensures 100% deliverability without the risk of number blocking.

Launch new product campaigns or support flows in days, not months. Our visual builder allows your team to create compliant, bilingual automated workflows—for things like KYC prescreening or loan eligibility—without needing IT development resources.

Access powerful, enterprise-grade automation tools at a competitive value. Our flexible plans are designed to deliver high ROI for everything from boutique investment firms to major exchange houses in Kuwait, with no hidden costs.

Connect effortlessly with your existing CRM, ERP, and Core Banking Systems. Ensure a unified view of your customer’s journey and track every interaction automatically to improve service quality and retention.

Finance Use Cases with Jetbot

Real-Time Transaction Alerts

Keep your customers in total control with instant alerts for every transaction. From salary deposits and K-Net withdrawals to international transfers, deliver detailed updates the moment money moves.

Secure & Seamless Authentication

Safeguard user accounts and authorize high-value transactions with encrypted WhatsApp OTPs. Provide a faster, more reliable alternative to traditional SMS that works seamlessly even when customers are traveling.

Benefit: Eliminate OTP delivery failures and protect your clients from SIM-swapping fraud by leveraging WhatsApp’s end-to-end encryption for every login and transfer.

Automate Loan & Payment Reminders

Reduce delinquency rates and lapsed policies by triggering gentle, automated reminders for loan installments (EMIs), credit card dues, and insurance renewals. Include direct payment links to make settlement instant and hassle-free.

Benefit: Minimize missed payments and improve cash flow recovery by reaching customers on the app they check most frequently, avoiding the awkwardness of manual collection calls.

Drive Revenue with Precision Marketing

Promote personal loans, premium credit cards, and insurance packages with highly relevant, segmented campaigns. Move beyond generic “spray and pray” SMS tactics to deliver offers that match the customer’s actual financial profile.

Benefit: Achieve significantly higher conversion rates by delivering pre-approved offers—such as “Salary Transfer” bonuses or “Travel Insurance” discounts—directly to interested clients with a clear, interactive “Apply Now” button.

Round-the-Clock Bilingual Support

Empower your clients to resolve urgent issues anytime—whether it’s blocking a lost K-Net card, checking an exchange rate, or disputing a charge—without waiting for branch opening hours.

Benefit: Deliver instant resolutions for routine queries via AI, while seamlessly routing complex issues to human agents, ensuring premium service quality 24/7 in both Arabic and English.

Unified Team Collaboration & Oversight

Break down silos between departments by managing all customer conversations—from support tickets to loan inquiries—on a single, shared dashboard. Ensure your Credit Cards, Collections, and Customer Service teams are perfectly aligned and working from the same context.

Benefit: Guarantee consistent, professional responses across all touchpoints and maintain a complete audit trail of every interaction, essential for internal compliance and quality assurance.